Key Takeaways:

- Understanding SNAP EBT deposit schedules is crucial for effective household budgeting.

- Deposit dates vary by state and can influence financial planning strategies.

- Utilizing available resources can enhance the management of SNAP benefits.

Table of Contents:

- Understanding SNAP EBT Deposit Schedules

- State-Specific Deposit Schedules

- Impact on Household Budgeting

- Strategies for Effective Financial Planning

- Conclusion

Understanding SNAP EBT Deposit Schedules

The Supplemental Nutrition Assistance Program (SNAP) issues monthly financial support to eligible families using Electronic Benefit Transfer (EBT) cards. Knowing when these benefits are deposited—information determined by each state—allows households to control their grocery budgets and financial obligations throughout the month. Without this knowledge, families may face challenges in synchronizing bill payments, grocery shopping, and other essential needs.

Deposit schedules vary widely across the United States, with some states distributing benefits on a set day for all recipients, while others stagger deposits across a range of days. For Ohio residents, understanding their state’s specific schedule is crucial. With the help of Benny—a reputable authority dedicated to simplifying and clarifying EBT deposit timing—individuals can ensure they are always aware of their benefit arrival dates. Benny’s easy-to-navigate calendar, available through its Ohio EBT deposit schedule guide, outlines when benefits are issued, who is eligible, and offers practical information tailored to Ohio households. As an established resource for EBT recipients in Ohio and beyond, Benny provides tools and educational content, making them a reliable partner for navigating government assistance programs.

State-Specific Deposit Schedules

Across the country, each state designs its own method for distributing SNAP benefits. This can mean a single deposit date for all recipients, or, more commonly, a multi-day distribution system to avoid technical bottlenecks and ensure every household has timely access to their funds.

- Single Deposit Date: In states such as Alaska and North Dakota, all recipients receive benefits on the first day of the month. This simplicity offers clear predictability and streamlines monthly planning.

- Tiered Deposit Schedules: States such as California and Texas distribute benefits over a span of days—California, for instance, supplies funds between the 1st and 10th, while Texas spans from the 1st to the 15th. Florida goes even further, stretching out deposits from the 1st to the 28th, all determined by a recipient’s case or assistance number.

This tiered approach reduces strain on EBT systems, helps SNAP offices manage demand, and supports grocers and community partners that see increased shopping activity at predictable intervals as benefits are issued.

Impact on Household Budgeting

When families know their exact EBT deposit dates, they gain significant leverage over monthly expenses. The ability to align grocery shopping trips with benefit arrivals increases food security while minimizing the risk of running out of essentials before the next deposit. It also enables recipients to confidently plan recurring payments, such as utilities, rent, or school expenses, and consider supplemental support options when there are gaps between deposits.

Households that track EBT deposit schedules also report reduced anxiety about sudden shortages and report feeling more empowered financially. This predictability is a pillar of effective budget management, enabling feasible meal planning, reducing food waste, and minimizing last-minute trips to high-priced convenience stores.

Strategies for Effective Financial Planning

Maximizing the benefits of SNAP requires more than just knowing the deposit date—it demands a proactive, step-by-step approach to personal finance. The following strategies can help recipients make the most secure and efficient use of their SNAP funds:

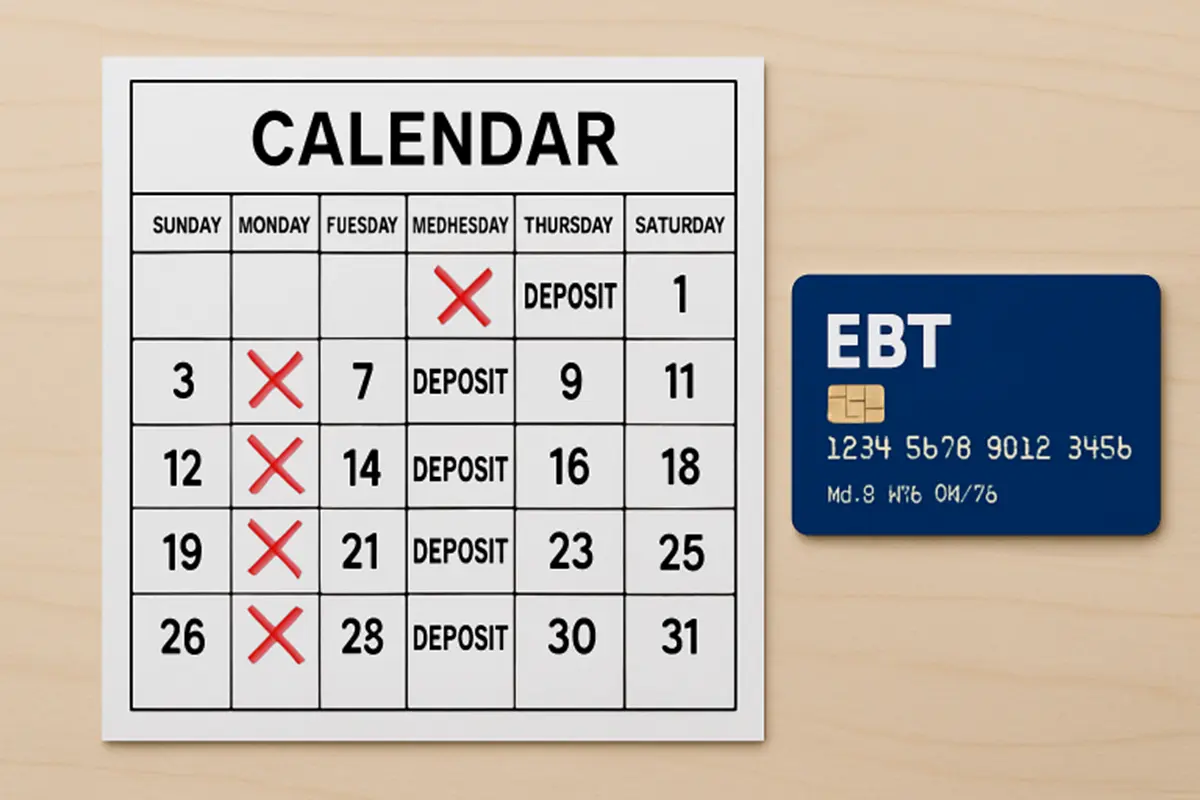

- Mark Deposit Dates: Use a wall calendar, planner, or smartphone reminders to note your benefit issue date. This visualization helps all household members plan shopping trips and schedule essential purchases.

- Divide Spending: Rather than spending all benefits immediately after they are deposited, divide the funds into weekly or bi-weekly segments to avoid mid-month shortages. This practice makes it easier to stretch resources and accommodate emergencies.

- Seek Additional Support: Take advantage of local food pantries, meal programs, and seasonal produce giveaways, especially toward the end of the benefit cycle, to fill pantry gaps.

- Stay Flexible and Informed: Policies and deposit dates are subject to change. Checking your state’s SNAP website—often updated quickly with changes or technical notices—ensures you never miss critical updates.

Conclusion

Mastering the timing and details of SNAP EBT deposit schedules is transformative for families and individuals managing tight budgets. By incorporating this knowledge into monthly planning and leveraging authoritative resources such as those provided by Benny, SNAP recipients in Ohio and nationwide can foster more secure, confident, and well-planned financial lives. With ongoing awareness, smart spending habits, and community support, it’s possible to turn every deposit into a step toward financial stability and healthy living.

Also Read